Free Wv Tax Form

Navigating the intricacies of tax forms can be daunting, yet understanding the West Virginia Personal Income Tax Forms for the year 2020 is crucial for residents to ensure compliance and optimize their financial outcomes. Scheduled for April 15, 2021, the submission deadline underscores the urgency for taxpayers to acquaint themselves with the form’s components, including schedules for various deductions, income adjustments, and credits. The form caters to diverse filing statuses, with sections meticulously designed for exemptions, federal adjusted gross income adjustments, and specific state tax considerations such as the Low-Income Earned Income Exclusion and senior citizen tax credits. Additionally, the guidance on potential tax liabilities or refunds, alongside options for direct deposits and e-payments, simplifies the process. With modifications for adjusted gross income that may decrease taxable income—ranging from Social Security benefits adjustments to deductions for contributions to state-run programs—residents can navigate their personal tax situation with greater clarity. Furthermore, special considerations are given to nonresidents and part-year residents, ensuring that every taxpayer's unique circumstances are addressed. Ultimately, the detailed instructions and inclusion of various schedules reveal the form’s comprehensive approach to accommodating the intricate details of personal income taxation in West Virginia.

Wv Tax Example

2021

Wൾ ඌ ඍ V උ ඇ ൺ

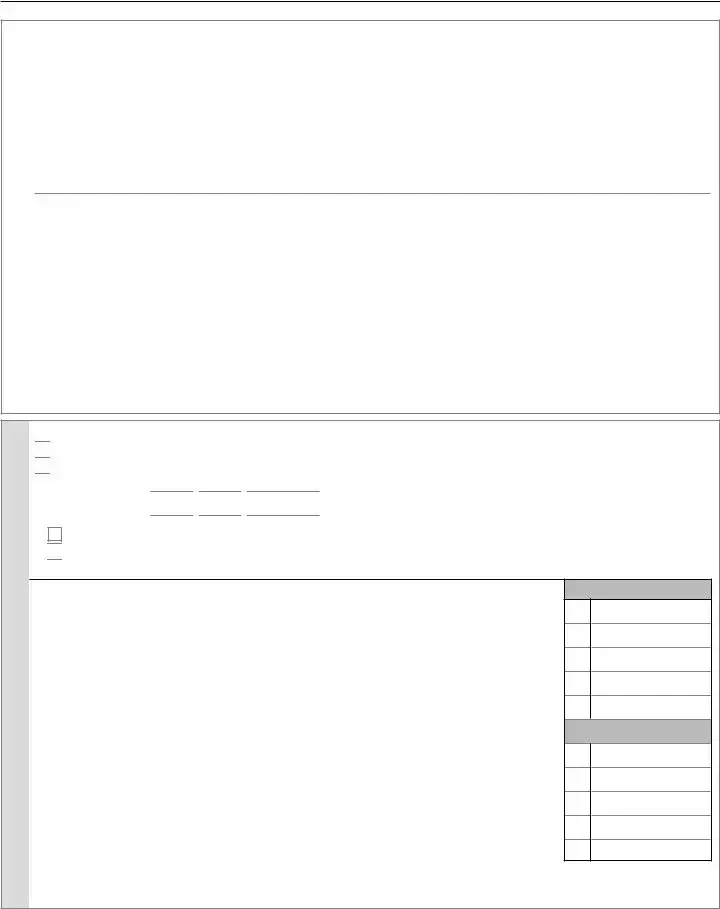

Personal Income Tax Forms & Instructions

2021 PERSONAL INCOME TAX IS DUE APRIL 18, 2022

WE S T V I R G I N I A S TAT E TA X D E PA RT M E N T

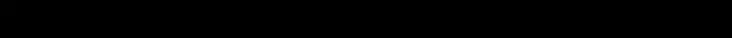

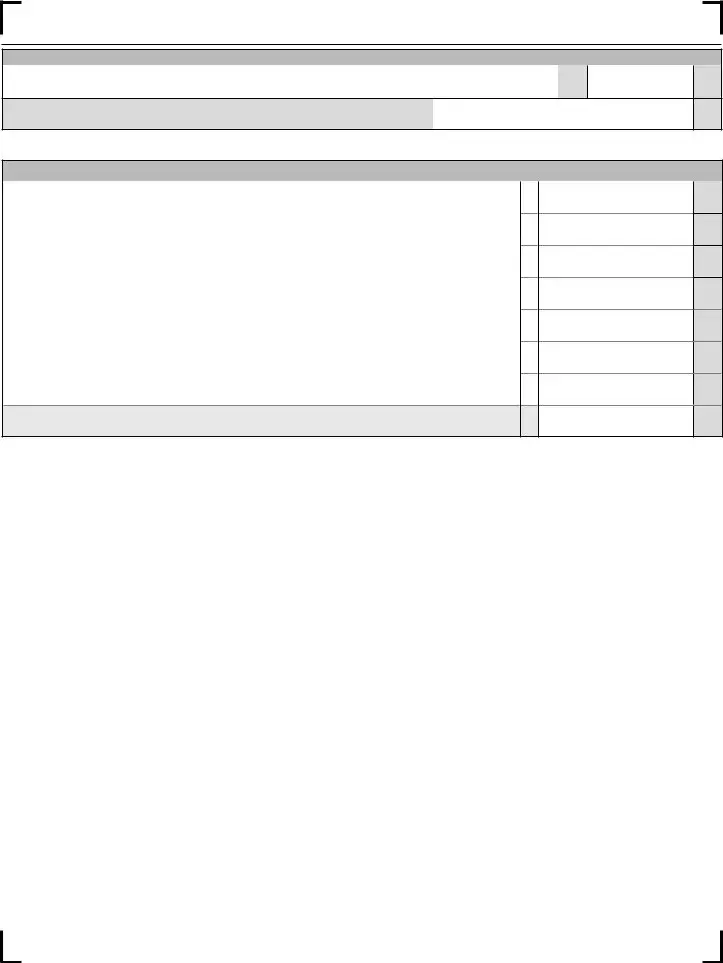

TABLE OF CONTENTS

Schedule UT Instructions |

10 |

|

Important Information for 2021 |

13 |

|

Tips on Filing a Paper Return |

14 |

|

General Information |

15 |

|

Form |

19 |

|

Schedule M Instructions |

21 |

|

Schedule A Instructions |

24 |

|

Schedule E Instructions |

26 |

|

Form |

27 |

|

2021 |

Family Tax Credit Tables |

31 |

2021 |

West Virginia Tax Table |

32 |

2021 |

Tax Rate Schedules |

37 |

Index |

49 |

|

COVER PHOTOGRAPH BY JINDALAY

|

|

W |

WEST VIRGINIA PERSONAL INCOME TAX RETURN |

2021 |

|

|

|

|

REV |

|

|

SOCIAL

SECURITY

NUMBER

LAST NAME

SPOUSE’S

LAST NAME

FIRST LINE OF

ADDRESS

CITY

TELEPHONE

NUMBER

Deceased |

|

|

*SPOUSE’S |

|

|

Deceased |

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

|

Date of Death: |

|

|

Date of Death: |

|||||||

NUMBER |

|

|

||||||||

|

|

|

|

|

YOUR |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

SPOUSE’S |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

SECOND LINE |

|

|

|

|

|

|

|

|

|

|

OF ADDRESS |

|

|

|

|

|

|

|

|

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

EXTENDED DUE DATE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

MM/DD/YYYY |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended return

Check before 4/18/22 if you wish to stop the original debit (amended return only)

Nonresident Special

Nonresident/

Form

1

2

3

4

5

FILING

STATUS

(Check One)

Single

Head of Household

Married, Filing Joint

Married, Filing

Separate

*Enter spouse’s SS# and name in the boxes above

Widow(er) with dependent child

|

|

|

|

Enter “1” in boxes a |

Yourself |

(a) |

|

|

Exemptions |

(If someone can claim you as a dependent, leave box (a) blank.) |

{ Spouse |

|

|

||||

and b if they apply |

(b) |

|

||||||

c. List your dependents. If more than five dependents, continue on Schedule DP on page 6. |

|

|

|

|

|

|||

First name |

|

Last name |

Social Security |

|

Date of Birth |

|

|

|

|

|

Number |

|

(MM DD YYYY) |

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Additional exemption if surviving spouse (see page 17) |

Enter total number of dependents |

(c) |

Enter decedents SSN: ______________________ Year Spouse Died: _____________________ |

(d) |

|

e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. |

(e) |

|

1.Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule

2.Additions to income (line 56 of Schedule M).............................................................................................

3.Subtractions from income (line 48 of Schedule M)....................................................................................

4.West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)......................................................

5.

6.Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 ........................................

7.West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............

8.Income Tax Due (Check One) .................................................................................................................

Tax Table |

|

Rate Schedule |

|

1

2

3

4

5

6

7

8

.00

.00

.00

.00

.00

.00

.00

.00

TAX DEPT USE ONLY

PAY COR SCTC NRSR HEPTC PLAN

MUST INCLUDE WITHHOLDING

FORMS WITH THIS RETURN

*P40202101W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

1 |

W |

|

PRIMARY LAST NAME |

|

|

|

|

|

|

SOCIAL SECURITY |

|

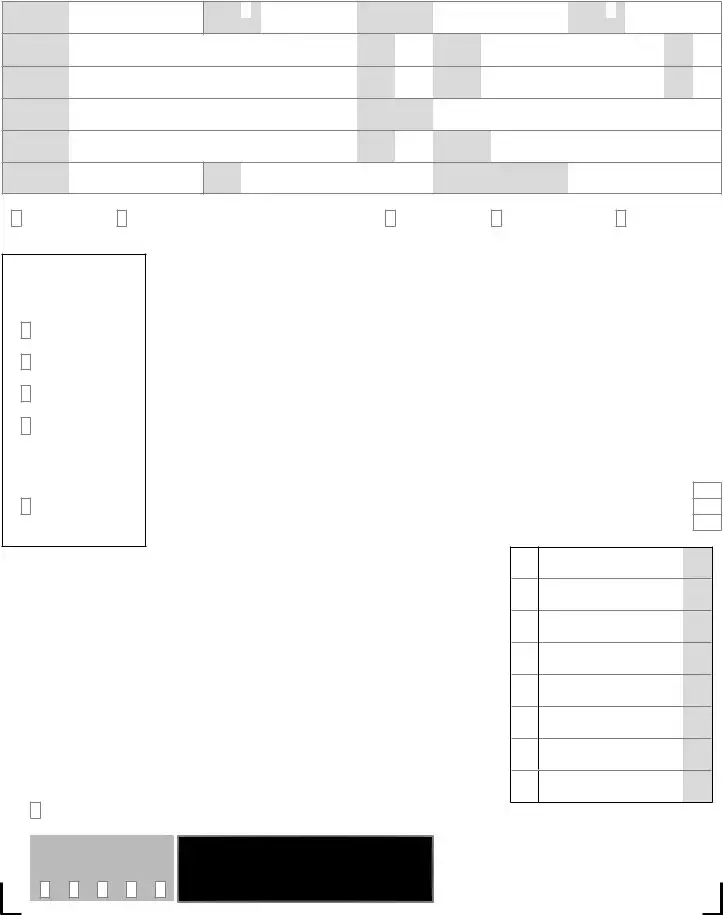

8.Total Taxes Due |

|

|

SHOWN ON FORM |

|

|

|

|

|

|

NUMBER |

|

(line 8 from previous page) |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

9. |

Credits from Tax Credit Recap Schedule (see schedule on page 5 ) (now includes the Family Tax Credit) |

9 |

|||

10. |

Line 8 minus 9. If line 9 is greater than line 8, enter 0 |

|

|

10 |

|

11. |

Overpayment previously refunded or credited (amended return only) |

........................................................... |

11 |

||

|

|

CHECK IF REQUESTING WAIVER/ANNUALIZED |

|

||

12. |

Penalty Due from Form |

WORKSHEET ATTACHED |

|

If you owe penalty, enter here |

12 |

13. |

West Virginia Use Tax Due on |

|

|

|

|

|

(See Schedule UT on page 9). |

|

CHECK IF NO USE TAX DUE |

13 |

|

14. |

Add lines 10 through 13. This is your total amount due |

|

14 |

||

|

|

|

Check if withholding from NRSR |

|

|

15. |

West Virginia Income Tax Withheld (See instructions) |

(Nonresident Sale of Real Estate) |

15 |

||

16. |

Estimated Tax Payments and Payments with Schedule 4868 |

|

16 |

||

17. |

17 |

||||

18. |

Senior Citizen Tax Credit for property tax paid (include Schedule |

18 |

|||

19. |

Homestead Excess Property Tax Credit for property tax paid (include Schedule |

19 |

|||

20. |

Amount paid with original return (amended return only) |

|

20 |

||

21. |

Payments and Refundable Credits (add lines 15 through 20) |

|

21 |

||

22. |

Balance Due (line 14 minus line 21). If Line 21 is greater than line 14, complete line 23 |

..... PAY THIS AMOUNT |

22 |

||

23. |

Line 21 minus line 14. This is your overpayment |

|

23 |

||

24. |

Donations of part or all of line 23. Indicate below and enter the sum of columns 24A, 24B, and 24C on Line 24 |

|

|||

|

24A. WEST VIRGINIA |

24B. WEST VIRGINIA DEPARTMENT OF |

|

24C. DONEL C. KINNARD MEMORIAL |

|

|

CHILDREN’S TRUST FUND |

VETERANS ASSISTANCE |

|

STATE VETERANS CEMETERY |

|

|

|

|

|

|

24 |

25. |

Amount of Overpayment to be credited to your 2022 estimated tax |

|

25 |

||

26. |

Refund due to you (line 23 minus line 24 and line 25) |

REFUND |

|

||

|

|

|

|

|

26 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Direct Deposit of Refund

CHECKING

SAVINGS

ROUTING NUMBER |

ACCOUNT NUMBER |

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Department to discuss my return with my preparer

YES

NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature |

|

|

Date |

Spouse’s Signature |

Date |

Telephone Number |

||||

|

|

Preparer: Check |

|

|

|

|

|

|

|

|

|

|

HERE if client is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

requesting that form |

|

|

|

|

|

|

|

|

|

|

NOT be |

|

|

|

|

|

|

|

|

|

|

Preparer’s EIN |

Signature of preparer other than above |

Date |

Telephone Number |

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

Preparer’s Printed Name |

|

|

Preparer’s Firm |

|

|

|||||

|

|

|

FOR REFUND, MAIL TO THIS ADDRESS: |

|

FOR BALANCE DUE, MAIL TO THIS ADDRESS: |

|

|

|||

|

|

|

WV STATE TAX DEPARTMENT |

|

|

WV STATE TAX DEPARTMENT |

|

|

||

|

|

|

|

P.O. BOX 1071 |

|

|

P.O. BOX 3694 |

|

|

|

|

|

|

CHARLESTON, WV |

|

|

CHARLESTON, WV |

|

|

||

Payment Options: Returns filed with a balance of tax due may pay through any of the following methods:

•Check or Money Order payable to the WV State Tax Department - Enclose check or money order with your return.

•Electronic Payment - May be made by visiting mytaxes.wvtax.gov and clicking on “Pay Personal Income Tax”.

•Credit Card Payment – May be made by visiting the Treasurer’s website at: epay.wvsto.com/tax

*P40202102W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

2 |

W |

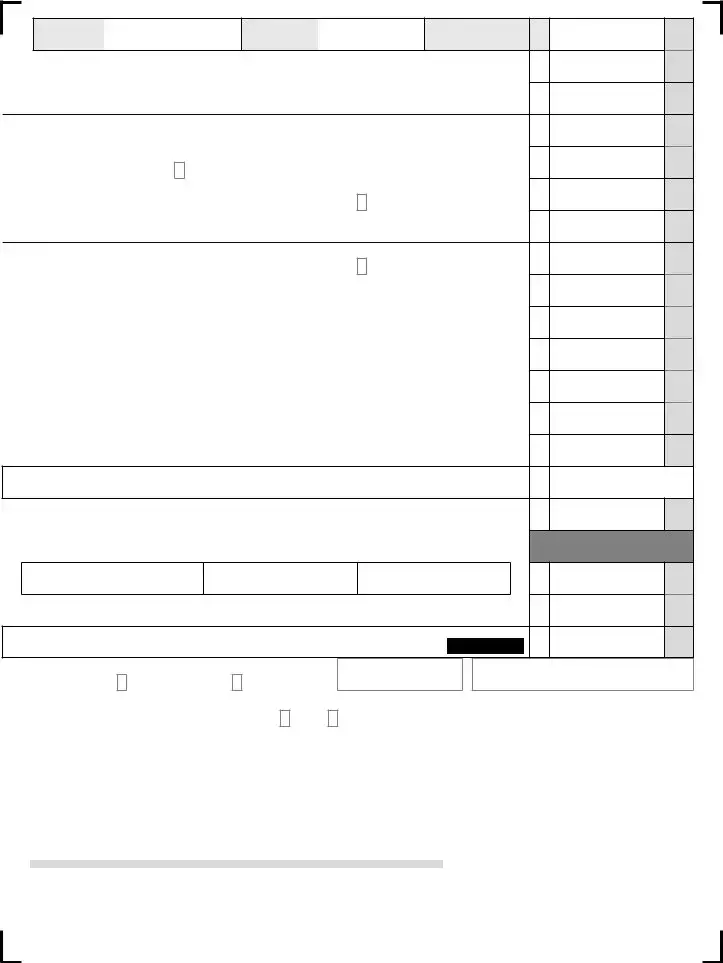

Schedule

Form

M W MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

|

Modifications Decreasing Federal Adjusted Gross Income |

|

|

Column A (You) |

Column B (Spouse) |

|||||||||||||||||

|

27. |

Interest or dividends received on United States or West Virginia obligations, or |

|

|

|

|

|

|

||||||||||||||

|

|

|

allowance for government obligation income, included in federal adjusted gross income |

27 |

|

.00 |

|

.00 |

||||||||||||||

|

|

|

but exempt from state tax |

|

|

|

|

|

|

|

|

|

||||||||||

|

28. |

Total amount of any benefit (including survivorship annuities) received from certain |

28 |

|

|

|

|

|

||||||||||||||

|

|

|

federal retirement systems by retired federal law enforcement officers |

|

|

.00 |

|

.00 |

||||||||||||||

|

29. |

Total amount of any benefit (including survivorship annuities) received from WV state |

29 |

|

|

|

|

|

||||||||||||||

|

|

|

or local police, deputy sheriffs’ or firemen’s retirement system, Excluding PERS |

|

.00 |

|

.00 |

|||||||||||||||

|

|

|

page 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. |

.....................................................................................Military Retirement Modification |

|

|

|

|

|

30 |

|

.00 |

|

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

31. |

Other Retirement Modification |

|

|

Column A (You) |

Column B (Spouse) |

|

|

|

|

|

|

||||||||||

|

(a) West Virginia Teachers’ and |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Public Employees’ Retirement |

|

|

|

.00 |

|

.00 |

|

Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000 |

|||||||||||

|

(b)Federal Retirement Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

(Title 4 USC §111) |

|

|

|

|

|

|

|

.00 |

|

.00 |

31 |

|

.00 |

|

.00 |

||||

|

32. |

Social Security Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(a) TOTAL Social Security Benefits. |

|

|

|

.00 |

|

.00 |

|

You cannot claim this modification if your Federal AGI exceeds |

|||||||||||||

|

(b) Benefits exempt for Federal tax |

|

|

|

|

|

|

|

$ 50,000 for SINGLE or MARRIED SEPARATE filers |

|||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

$100,000 for MARRIED JOINT filers |

||||||||||||||

|

|

|

purposes |

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

Multiply 32 (c) by 0.65 |

|

|

|

||

|

(c) Benefits taxable for Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

purposes (line a minus line b) |

|

|

|

|

.00 |

|

.00 |

32 |

|

.00 |

|

.00 |

|||||||

|

33. |

Certain assets held by subchapter S Corporation bank |

.................................................. |

|

|

33 |

|

.00 |

|

.00 |

||||||||||||

|

34. |

Active Duty Military pay for personnel with West Virginia Domicile |

|

34 |

|

.00 |

|

.00 |

||||||||||||||

|

|

|

(See instructions on page 22) |

........................................................................................ |

|

|

|

|

|

|

|

|

||||||||||

|

35. |

Active Military Separation (see instructions on page 22) |

|

|

35 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

Must enclose military orders and discharge papers |

|

|

|

|

|||||||||||||||

|

36. |

Refunds of state and local income taxes received and reported as income to the IRS ... |

36 |

|

.00 |

|

.00 |

|||||||||||||||

|

37. |

Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds |

|

37 |

|

.00 |

|

.00 |

||||||||||||||

|

38. |

Railroad Retirement Board Income received |

.................................................................. |

|

|

|

38 |

|

.00 |

|

.00 |

|||||||||||

|

39. |

|

|

|

|

|

|

39 |

|

.00 |

|

.00 |

||||||||||

|

40. |

IRC 1341 Repayments |

|

|

|

|

|

|

|

40 |

|

.00 |

|

.00 |

||||||||

|

41. |

Autism Modification (instructions on page 22) |

|

|

41 |

|

.00 |

|

.00 |

|||||||||||||

|

42. |

ABLE Act |

....................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

42 |

|

.00 |

|

.00 |

||||

|

43. |

PBGC Modification |

..................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(a) retirement benefits that would have been |

|

|

|

.00 |

|

.00 |

|

Subtract line 43 (b ) from (a) |

|

|

|

||||||||||

|

|

|

paid from your |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(b) retirement benefits actually received |

|

|

|

.00 |

|

.00 |

43 |

|

.00 |

|

.00 |

||||||||||

|

|

|

from PBGC |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

44. |

Qualified Opportunity Zone business income |

|

|

44 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

(a) Year |

of birth |

(b) |

Year |

of |

(c) Income not included in |

(d) Add lines 27 through 32 |

|

|

|

|

|

|

||||||

|

45. |

|

(65 or older) |

|

disability |

|

lines 33 to 44 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Subtract line 45 column (d) from (c) (If less than zero, enter zero) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

(NOT TO EXCEED $8000) |

|

|

|

|||||||||

|

You |

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

|

.00 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Spouse |

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

45 |

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

*P40202103W* |

46. Surviving spouse deduction |

46 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

Continues on next page |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(instructions on page 23) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications Decreasing Federal Adjusted Gross Income |

||||||||

|

|

|

|

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

3 |

W |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

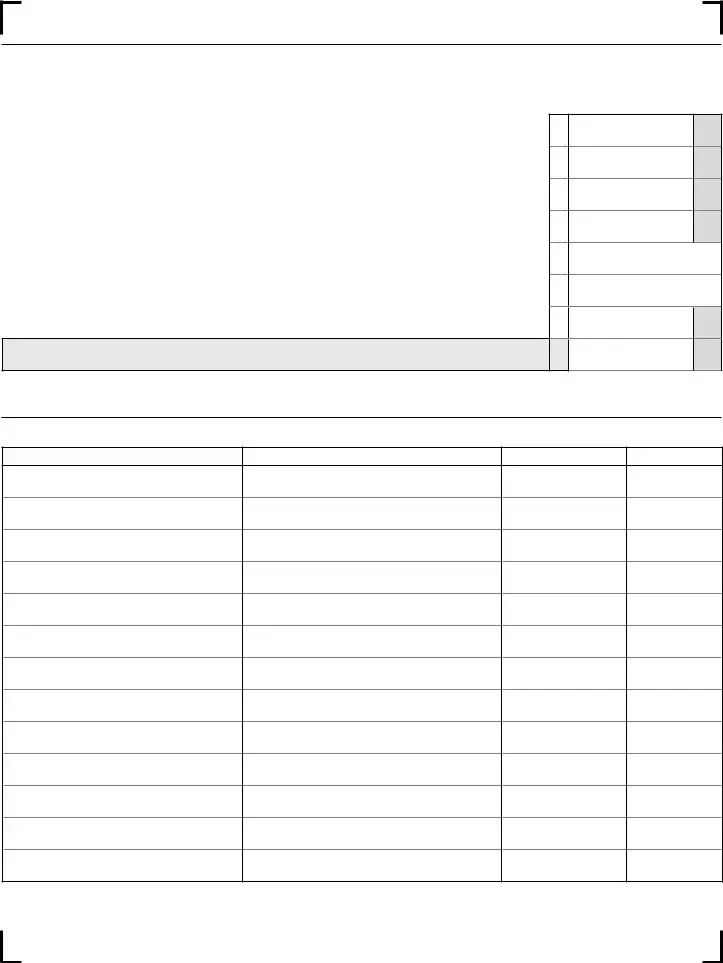

Schedule

Form

M W MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

Modifications Decreasing Federal Adjusted Gross Income |

Column A (You) |

Column B (Spouse) |

47. Add lines 27 through 46 for each column |

47 |

|

.00 |

48.Total Subtractions (line 47, Col A plus line 47,Col B) Enter here and on line 3 of FORM |

48 |

|

|

|

|

|

|

.00

.00

Modifications Increasing Federal Adjusted Gross Income |

|

|

49. |

Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax |

49 |

50. |

Interest or dividend income on state and local bonds other than bonds from West Virginia sources |

50 |

51. |

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax |

51 |

52. |

Qualifying 402(e) |

52 |

53. |

Other income deducted from federal adjusted gross income but subject to state tax |

53 |

54. |

Withdrawals from a WV Prepaid Tuition/Savings Plan Trust Funds NOT used for payment of qualifying expenses |

54 |

55. |

ABLE ACT withdrawals not used for qualifying expenses |

55 |

56.TOTAL ADDITIONS (Add lines 49 through 55). Enter here and on Line 2 of Form |

56 |

|

.00

.00

.00

.00

.00

.00

.00

.00

*P40202104W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

4 |

W |

RECAP |

W |

TAX CREDIT RECAP SCHEDULE |

2021 |

Form |

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this sum- mary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no longer required to enclose the other state(s) return(s) or the

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

|

|

TAX CREDIT |

SCHEDULE |

APPLICABLE CREDIT |

|||||||

1. |

................................................Credit for Income Tax paid to another state(s) |

E |

1 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

** For what states? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

....................................................................Family Tax Credit (see page 39) |

2 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

3. |

......................................................General Economic Opportunity Tax Credit |

WV |

3 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

4. |

..........................................WV Environmental Agricultural Equipment Credit |

WV |

4 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

5. |

............................................................................WV Military Incentive Credit |

J |

5 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

6. |

.....................................................Neighborhood Investment Program Credit |

6 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

7. |

........................................Historic Rehabilitated Buildings Investment Credit |

RBIC |

7 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

8. |

...................Qualified Residential Rehabilitated Buildings Investment Credit |

8 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

9. |

................................................................Apprenticeship Training Tax Credit |

WV |

9 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

10. |

10 |

|

.00 |

|

|||||||

|

|

|

|

|

|

|

|||||

11. |

..................................................................Conceal Carry Gun Permit Credit |

11 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

.........................................................................12. Farm to Food Bank Tax Credit |

|

12 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

13. |

.................Downstream Natural Gas Manufacturing Investment Tax Credit |

DNG- 2 |

13 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

14. |

Post Coal Mine Site Business Credit |

14 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

15. |

.......................................................................................Natural Gas Liquids |

15 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

16. |

Donation or Sale of Vehicle to Qualified Charitable Organizations |

16 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

17. |

Small Arms And Ammunition Manufacturers Credit |

17 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

18.TOTAL CREDITS — add lines 1 through 17. Enter on Form |

18 |

|

.00 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202105W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

5 |

W |

Schedule

Form

FAMILY TAX CREDIT |

2021 |

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal income tax. You may be entitled to this credit if you meet certain income limitations and family size. Individuals who file their income tax return with zero exemptions cannot claim the credit. Persons who pay the federal alternative minimum tax are not eligible to claim this credit. In order to determine if you are eligible for this credit, complete the schedule below and attach to Form

If this schedule is not enclosed with Form

1.Federal Adjusted Gross Income (enter the amount from line 1 of Form

2.Increasing West Virginia modifications (enter the amount from line 2 of Form

3.

4.Add lines 1 through 3. This is your Modified Federal Adjusted Gross Income for the Family Tax Credit............

5.Enter the number of exemptions claimed from Form

6.Enter the Family Tax Credit Percentage for your family size AND Modified Federal Adjusted Gross Income level from the tables on page 31. If the exemptions on line 5 are greater than 8, use the table for a family size of 8

7.Enter your income tax due from line 8 of Form

8.Multiply the amount on line 7 by the percentage shown on line 6

This is your Family Tax Credit. Enter this amount on line 2 of Form

1

2

3

4

5

6

7

8

.00

.00

.00

.00

.00

.00

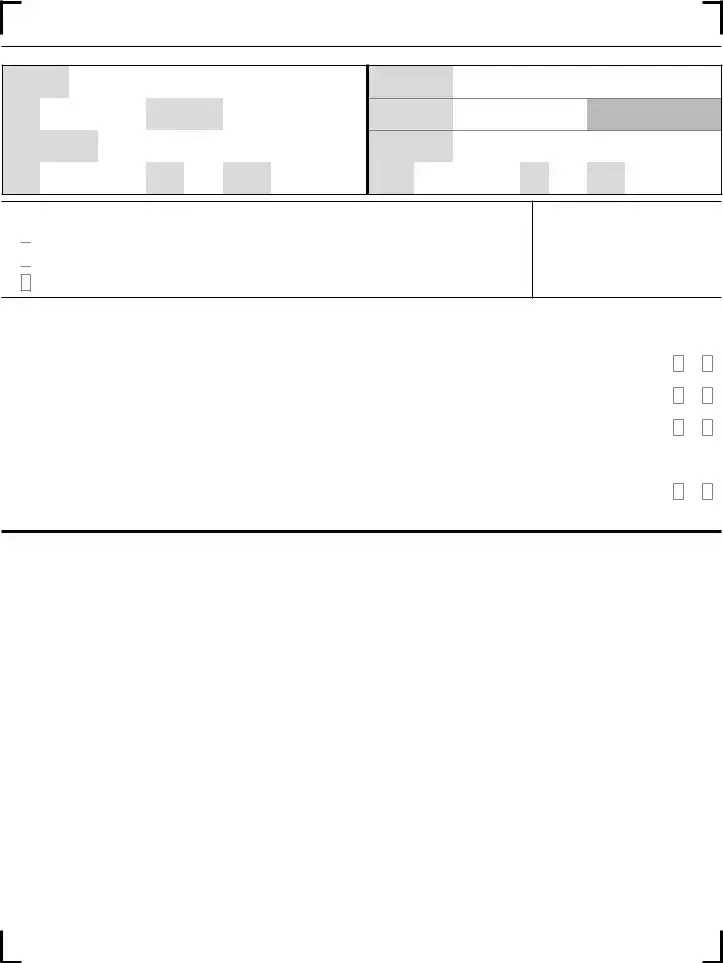

Schedule

Form

DPSCHEDULE OF ADDITIONAL DEPENDENTS 2021

Use this schedule to continue listing dependents. If space is needed for more than 18 dependents, a copy of this form may be obtained from the West Virginia State Tax Department’s website: tax.wv.gov.

First Name

Last Name

Social Security Number

Date of Birth

MM DD YYYY

*P40202110W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

1 |

0 |

W |

Schedule

F

Form

STATEMENT OF CLAIMANT |

2021 |

TO REFUND DUE DECEASED TAXPAYER |

Attach completed schedule to decedent’s return

NAME OF

DECEDENT

DATE OF |

SOCIAL SECURITY |

|

|

DEATH |

NUMBER |

|

|

|

|

|

|

ADDRESS |

|

|

|

(permanent residence or |

|

|

|

domicile at date of death) |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

NAME OF

CLAIMANT

SOCIAL SECURITY

NUMBER

ADDRESS

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return

Surviving wife or husband, claiming a refund based on a joint return

B. Administrator or executor. Attach a court certificate showing your appointment.

Administrator or executor. Attach a court certificate showing your appointment.

C.Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach a copy of the death certificate or proof of death*

ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME AND ADDRESS OF THE SURVIV- ING SPOUSE AND CHILDREN OF THE DECEDENT.

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3.Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu- tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202116W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

1 |

6 |

W |

Schedules

H & E

Form

CERTIFICATION FOR PERMANENT AND TOTAL DISABILITY |

2021 |

AND CREDIT FOR INCOME TAX PAID TO ANOTHER STATE |

SCHEDULE H CERTIFICATION OF PERMANENT AND TOTAL DISABILITY

TAXPAYERS WHO ARE DISABLED DURING 2021 REGARDLESS OF AGE

If you were certified by a physician as being permanently and totally disabled during the taxable year 2021, OR you were the surviving spouse of an individual who had been certified disabled and DIED DURING 2021, read the instructions to determine if you qualify for the income reducing modification allowed on Schedule M.

If you qualify, you must (1) enter the name of and social security number of the disabled taxpayer in the space provided on this form, (2) have a physician complete the remainder of the certification statement and return it to you, (3) enclose the completed certification with your West Virginia personal income tax return, and (4) complete Schedule M to determine your modification.

A COPY OF YOUR FEDERAL SCHEDULE R (PART II) MAY BE SUBSTITUTED FOR THE WEST VIRGINIA SCHEDULE H.

If you have provided the West Virginia State Tax Department with an approved Certification of Permanent and Total Disability for a prior year AND YOUR DISABILITY STATUS DID NOT CHANGE FOR 2021, you do not have to submit this form with your return. However, you must have a copy of your original disability certification should the Department request verification at a later date.

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2021.

|

Name of Disabled Taxpayer |

Social Security Number |

|

||

|

|

|

|

|

|

|

Physician’s Name |

Physician's FEIN Number |

|

||

|

|

|

|

|

|

|

Physician’s Street Address |

|

|

||

|

|

|

|

|

|

|

City |

State |

Zip Code |

||

Physicians |

|

Date |

|

|

|

|

|

|

|||

|

|

|

|

|

|

Signature |

|

|

MM |

DD |

YYYY |

|

|

|

|||

|

|

|

|

|

|

INSTRUCTIONS TO PHYSICIAN COMPLETING DISABILITY STATEMENT

A PERSON IS PERMANENTLY AND TOTALLY DISABLED WHEN HE OR SHE IS UNABLE TO ENGAGE IN ANY SUBSTANTIAL GAINFUL ACTIVITY BECAUSE OF A MENTAL OR PHYSICAL CONDITION AND THAT DISABILITY HAS LASTED OR CAN BE EXPECTED TO LAST CONTINUOUSLY FOR AT LEAST A YEAR, OR CAN BE EXPECTED TO LEAD TO DEATH. IF, IN YOUR OPINION, THE INDIVIDUAL NAMED ON THIS STATEMENT IS PERMANENTLY AND TOTALLY DISABLED DURING 2021, PLEASE CERTIFY SUCH BY ENTERING YOUR NAME, ADDRESS, SIGNATURE, DATE, AND FEIN NUMBER IN THE SPACES PROVIDED ABOVE AND RETURN TO THE INDIVIDUAL.

ANOTHER STATE

RESIDENCY STATUS

Resident

Resident

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

MM DD YYYY Moved into West Virginia

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

SCHEDULE E CREDIT FOR INCOME TAX PAID TO

1.INCOME TAX COMPUTED on your 2021 _________________ return. Do not report Tax Withheld State Abbreviation

2.West Virginia total income tax (line 8 of Form

3.Net income derived from above state included in West Virginia total income.....................................................

4.Total West Virginia Income

5.Limitation of Credit (line 2 multiplied by line 3 divided by line 4).........................................................................

6. Alternative West Virginia taxable income Residents – subtract line 3 from line 7, Form

7.Alternative West Virginia total income tax (Apply the Tax Rate Schedule to the amount shown on line 6).........

8.Limitation of credit (line 2 minus line 7)...............................................................................................................

9.Maximum credit (line 2 minus the sum of lines 2 through 17 of the Tax Credit Recap Schedule)

10.Total Credit (SMALLEST of lines 1,2, 5, 8, or 9) enter here and on line 1 of the Tax Credit Recap Schedule.

1

2

3

4

5

6

7

8

9

10

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

A SEPARATE SCHEDULE E MUST BE COMPLETED FOR EACH STATE FOR WHICH CREDIT IS CLAIMED. YOU MUST MAINTAIN A COPY OF THE OTHER STATE TAX RETURN IN YOUR FILES. IN LIEU OF A RETURN YOU MAY MAINTAIN AN INFORMATION STATEMENT AND THE WITHHOLDING STATEMENTS PROVIDED BY THE PARTNERSHIP, LIMITED LIABILITY COMPANY OR

Form Specifications

| Fact | Detail |

|---|---|

| Due Date | Personal income tax for the year 2020 was due on April 15, 2021. |

| Form IT-140 | This form is designated for West Virginia Personal Income Tax Return for the year 2020. |

| Exemptions | Taxpayers could claim exemptions for themselves, a spouse, dependents, and as a surviving spouse on the IT-140 form. |

| Governing Law | The form is subject to the tax laws and regulations of the State of West Virginia, as administered by the West Virginia State Tax Department. |

| Tax Modifications | Includes various modifications to adjusted gross income, such as deductions for Federal retirement income, Social Security benefits modification, military pay, and contributions to specific West Virginia funds. |

Guide to Filling Out Wv Tax

Filing tax returns is a critical process that ensures compliance with federal and state tax laws. For residents of West Virginia needing to file their personal income tax, understanding how to complete the IT-140 form correctly is essential. Below are step-by-step instructions that will guide you through filling out this form. Remember, accurate and timely submission of your tax return is crucial to avoid any penalties or interests for late payments. Once completed, review the instructions on where to mail your return or how to file it electronically, depending on whether you owe a balance or are expecting a refund.

- Start with your Social Security Number at the top left corner of the form.

- Enter your Last Name and, if applicable, your spouse’s last name, along with your first names and middle initials.

- Fill in your complete Address, including the first and second line of address, city, state, and zip code.

- Provide your Telephone Number and Email Address for communication purposes.

- Check the appropriate boxes if this is an Amended return, and for other specific conditions like deceased taxpayers.

- Select your Filing Status by checking the relevant box.

- Under Exemptions, indicate Yourself and Spouse if applicable, and list any dependents including their social security number and date of birth.

- Enter your Federal Adjusted Gross Income in the provided space. This is from your federal tax return.

- Add any Additions to Income as listed on Schedule M and enter the total.

- Subtract any eligible Subtractions from Income, also detailed on Schedule M.

- Calculate your West Virginia Adjusted Gross Income.

- Determine your Low-Income Earned Income Exclusion if applicable.

- Calculate your Total Exemptions and enter this amount.

- Figure out your West Virginia Taxable Income and enter it.

- Use the Tax Table or Rate Schedule to find your Income Tax Due.

- On the second page, input any Taxes Paid, starting with line 8 from the previous page.

- Enter any applicable credits, including the Family Tax Credit if eligible.

- Calculate any Overpayment and decide if you want it refunded or credited towards next year’s taxes.

- Sign and date the form, ensuring both you and your spouse sign if filing jointly.

- Review the directions for either Refund or Balance Due mailing addresses to send your completed form.

After completing and reviewing the IT-140 form for accuracy, you are ready to file. If expecting a refund, you might consider direct deposit for faster processing. Remember, filling out this form accurately and submitting it before the deadline is crucial. This ensures you comply with state tax laws and avoid potential penalties. Should you have questions or uncertainties, consulting with a tax professional or the WV State Tax Department can provide additional clarity and support.

Things You Should Know About Wv Tax

When is the 2020 West Virginia (WV) Personal Income Tax due?

The deadline for filing the 2020 WV Personal Income Tax is April 15, 2021. Taxpayers must submit their returns by this date to avoid potential penalties and interest charges for late filing. If the due date falls on a weekend or a legal holiday, the deadline is extended to the next business day.

What are the different filing statuses available on the WV Personal Income Tax Form (IT-140)?

The WV Personal Income Tax Form IT-140 offers several filing statuses to accommodate different taxpayer situations. Taxpayers can choose from Single, Head of Household, Married Filing Jointly, Married Filing Separately, and Widow(er) with Dependent Child. The choice of filing status affects the tax rate and applicable deductions, so it's crucial to select the most appropriate status based on your circumstances.

How can I claim exemptions on my West Virginia Personal Income Tax return?

Exemptions reduce your taxable income. On the WV Personal Income Tax Form IT-140, you can claim exemptions for yourself (if nobody else claims you as a dependent), your spouse, and dependents. Enter the total number of exemptions in the designated section on the form. Remember, exemptions directly influence the total exemption amount you subtract from your gross income to determine your taxable income.

What should I do if I made a mistake on my filed WV Personal Income Tax return?

If you discover an error on your already filed WV Personal Income Tax return, you should file an amended return. The state provides specific forms for this purpose, such as Form IT-140X for amended personal income tax returns. When filing an amended return, check the box indicating it's an amendment, correct the information, and provide any additional documentation if required. This ensures your tax responsibilities are accurately reflected and can prevent potential penalties.

Common mistakes

Filling out tax forms can often be overwhelming, leading to common mistakes that can affect the submission and processing of your tax return. This is particularly true for the West Virginia Personal Income Tax Return form. Here are five common mistakes to be aware of and avoid:

- Incorrect or Incomplete Personal Information: One of the most frequent errors is not entering the full social security number, misspelling names, or providing incorrect addresses. This mistake can delay processing and potentially impact the timely delivery of any refunds owed.

- Filing Status Confusion: Taxpayers sometimes select the wrong filing status. This mistake can affect tax liability, available credits, and deductions. It’s vital to understand each status and choose the one that accurately reflects your situation for that tax year.

- Errors in Deductions and Credits: Many individuals either claim deductions and credits they are not eligible for or fail to claim ones they are eligible for. Overlooking the instructions for schedules such as the Earned Income Credit or the Family Tax Credit can lead to missing out on valuable tax benefits.

- Mathematical Errors: Another common mistake is incorrect calculations. Whether it's adding and subtracting income and deductions or incorrectly calculating tax based on the taxable income, these errors can significantly impact the accuracy of the tax return and the amount of tax or refund due.

- Omitting Income or Incorrectly Reporting Income: Not including all sources of income or incorrectly entering income amounts can lead to discrepancies. This is especially true for those who may have multiple W-2s, 1099 forms, or other sources of income that must be reported.

To minimize these and other errors, carefully reading the instructions provided with the tax forms is crucial. If doubts arise, consulting a tax professional can help. Additionally, considering electronic filing options can reduce the risk of making these mistakes, as many software options include error checks and guides to assist taxpayers through the process.

Remember, the goal is to provide an accurate and complete representation of your financial situation over the past year to the West Virginia State Tax Department. Paying attention to detail and staying informed about the tax laws affecting you can make the process smoother and help ensure that you meet your legal obligations while maximizing your potential benefits.

Documents used along the form

When dealing with the West Virginia Tax Form IT-140, several other documents often come into play to complete an individual's tax filing accurately. These documents are essential for providing detailed information or for claiming specific tax benefits that may apply to the taxpayer's situation. Understanding the purpose of each document can aid in ensuring a thorough and compliant tax return process.

- W-2 Forms: These are wage and tax statements provided by an employer, detailing the employee's income and tax deductions for the year. They are crucial for reporting gross income on the West Virginia Tax Form.

- 1099 Forms: These documents report various types of income other than wages, salaries, and tips. For example, 1099-DIV reports dividends and distributions, while 1099-INT pertains to interest income.

- Schedule A (Itemized Deductions): This schedule is used if the taxpayer decides to itemize deductions rather than take the standard deduction. It includes expenses like certain medical and dental expenses, taxes paid, interest paid, gifts to charity, and casualty and theft losses.

- Schedule E (Supplemental Income and Loss): This form is for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form WV-8379 (Injured Spouse Allocation): This form allows a spouse to claim their portion of a joint refund when the other spouse has past due debts that the state might use the refund to pay off.

- Schedule M (Modifications to Adjusted Gross Income): Used to report additions and subtractions to federal adjusted gross income, which helps calculate West Virginia adjusted gross income accurately.

- Schedule UT (Consumer Sales and Service Tax and Use Tax): Required for reporting use tax due on out-of-state purchases, a critical component for taxpayers who buy goods online or outside of West Virginia without paying state sales tax.

Each of these forms serves a specific function in the broader tax return process, allowing taxpayers to report income accurately, claim deductions and credits, and comply with state and federal tax laws. Ensuring that all relevant documents are accurately completed and submitted with the West Virginia Tax Form IT-140 can help avoid processing delays and ensure the taxpayer receives any due refunds or credits efficiently.

Similar forms

The IRS Form 1040, "U.S. Individual Income Tax Return," is closely related to the WV Tax Form, particularly the IT-140 West Virginia Personal Income Tax Return. The IRS Form 1040 serves as the foundational document for individual federal tax filing in the United States, capturing taxpayer income, deductions, credits, and taxes owed. Similarly, the West Virginia IT-140 focuses on these elements but adjusts for state-level income and allowances. Both forms ensure compliance with respective tax laws while allowing taxpayers to claim various deductions and credits applicable to their financial situation.

Form W-2, "Wage and Tax Statement," is another document akin to the WV Tax Form, primarily because it provides essential information required to complete tax returns. Employers issue Form W-2 to employees, detailing annual wages and the amount of taxes withheld from their paycheck. Taxpayers need this information when filling out both the West Virginia IT-140 form and federal tax forms to accurately report their income and tax payments.

Form 1099-MISC, "Miscellaneous Income," is similar to the WV Tax Form in that it reports income that might not be traditionally wage-based but is still crucial for accurate tax reporting. Independent contractors, freelancers, and others who receive income outside of traditional employment use this form to report payments received. Like the W-2, information from a 1099-MISC must be included in tax filings, including the West Virginia IT-140, for a comprehensive accounting of annual income.

The Schedule C, "Profit or Loss from Business," is used by sole proprietors and single-member LLCs to report business profits and losses to the IRS and has a counterpart in the WVIT-140 through Schedule M modifications. While Schedule C focuses on federal tax obligations by detailing expenses and revenues of a business, it influences state tax obligations by affecting the taxpayer’s federal adjusted gross income, which is reported on the IT-140 form for West Virginia.

Form 4868, "Application for Automatic Extension of Time To File U.S. Individual Income Tax Return," parallels the provision within the WV Tax Form allowing for an extended due date. Taxpayers who need more time to gather documents, complete their returns, or consult with tax professionals can request extensions. Although Form 4868 specifically grants additional time for federal returns, West Virginia also offers a mechanism for taxpayers to delay state filing, emphasizing the need for flexibility in meeting tax obligations.

Schedule A, "Itemized Deductions," which is attached to the IRS Form 1040, shares similarities with parts of the WV Tax Form that allow for itemized deductions. While Schedule A covers deductions like medical expenses, state and local taxes, and charitable contributions at the federal level, the West Virginia tax documents also provide avenues for taxpayers to reduce taxable income through allowances for certain state-specific deductions, reflecting the parallel structure of reducing taxable income through qualifying expenses.

The Schedule E, "Supplemental Income and Loss," is used for reporting income from rental real estate, royalties, partnerships, S corporations, trusts, and estates. This relates to the WV Tax Form as it feeds into the taxpayer's overall financial picture, impacting the adjusted gross income reported on the state return. The inclusion of income from these sources ensures accurate tax liability calculations, underscoring the comprehensive approach to tax documentation.

Form IT-210, "Underpayment of Estimated Tax by Individuals," mirrors aspects of the WV Tax Form concerning penalty calculations for underpayments. Just as individuals who do not adequately cover their tax liability through withholding or estimated tax payments may face penalties on their federal returns, West Virginia assesses penalties for underpayment, indicating the universal importance of paying taxes due in a timely manner.

The West Virginia Schedule UT, "Use Tax," compares to the concept of reporting and paying use tax at the federal level for items purchased without sales tax, akin to online purchases from out-of-state sellers. The inclusion of this schedule within the WVIT-140 instructions highlights the state's efforts to ensure all due taxes, not just income taxes, are collected, reflecting the broader tax system's multifaceted nature.

Form WV-8379, "Injured Spouse Allocation," is associated with the WV Tax Form, resembling the injured spouse provisions in federal tax law. This form allows a spouse to claim their share of a tax refund if it’s being applied to the other spouse's past-due obligations, such as child support. This process illustrates the tax system's recognition of individual rights within collective tax obligations, ensuring fair treatment of all taxpayers.

Dos and Don'ts

When preparing to fill out the WV Tax Form, ensuring accuracy and compliance with the guidelines is crucial. The process can be intricate, and overlooking details can lead to errors, delays, or potential penalties. To assist in this process, here is a compiled list of things you should and shouldn't do:

- Do review the entire form before starting to ensure you understand all requirements.

- Do gather all necessary documents, such as W-2s, 1099s, and records of any deductions or credits you plan to claim.

- Do use black or blue ink if filling out the form by hand to ensure legibility and prevent smudging.

- Do double-check all numbers and calculations to avoid basic math errors that could affect your tax liability.

- Do consider using the direct deposit option for a faster refund. Ensure all provided bank details are accurate to avoid delays.

- Do sign and date your tax return; unsigned forms are considered invalid and will not be processed.

- Do keep a copy of your filled-out form and all supporting documents for your records.

- Don't leave any fields blank. If a section does not apply to you, enter "0" or "N/A" to indicate this.

- Don't estimate amounts. Use your documentation to report exact numbers to ensure your return is accurate.

- Don't forget to include your Social Security Number and double-check it for accuracy to prevent processing issues.

- Don't ignore the instructions for each line and schedule; misunderstanding what to report can lead to errors.

- Don't omit any income, regardless of whether it was reported to you on a form, as all income must be reported.

- Don't incorrectly claim deductions or credits; ensure you're eligible for them before including them on your return.

- Don't rush through filling out your form. Taking your time can help you avoid mistakes and ensure your return is completed correctly.

By adhering to these guidelines, you can fill out your WV Tax Form more thoroughly and accurately, reducing the risk of delays or issues with your tax return. Remember, paying attention to detail and staying organized are key components of successfully completing tax forms.

Misconceptions

When it comes to West Virginia Tax forms, especially the personal income tax forms, there are several misconceptions that can lead to confusion. Here's a clear-up on some of the most common misunderstandings:

Misconception #1: The deadline is always April 15. While the traditional due date for filing taxes is April 15, it can change due to weekends and public holidays. The due date is extended to the next business day when April 15 falls on a weekend or a legal holiday.

Misconception #2: Nonresidents don’t need to file. Nonresidents who earn income in West Virginia need to file a state tax return. This includes income earned from any source within the state, regardless of where the individual lives.

Misconception #3: Amending a return is optional. If you discover an error on your original tax return, you should file an amended return to correct it. This ensures your tax liabilities are accurate, potentially avoiding penalties and interest for underpayment or providing an opportunity for a refund if you overpaid.

Misconcentration #4: Direct deposit is only for refunds. While it's well-known that you can receive your refund via direct deposit, it's less commonly understood that you can also pay any taxes you owe through electronic methods, including direct withdrawal from a bank account.

Misconception #5: All income is taxable at the same rate. West Virginia has a progressive tax system, meaning that tax rates increase as income reaches higher brackets. Not all of your income may be taxed at the same rate, depending on your total income.

Misconception #6: Married couples must file jointly. While many married couples choose to file jointly, filing separately may be beneficial in certain situations. It's important to consider both options and choose the one that results in lower overall taxes.

Misconception #7: You can’t claim a refund for overpaid taxes after the deadline. Taxpayers generally have up to three years from the due date of the return to claim a refund for overpaid taxes. It’s better to file late and claim your refund than not to file at all if you believe you've overpaid.

Misconception #8: Filing a paper return is faster. In reality, filing electronically is significantly faster in terms of both processing your return and receiving any refund owed. Electronic filing also reduces the risk of errors, which can further delay processing.

Understanding these facts can help avoid mistakes and make the filing process smoother. If you're uncertain about your tax situation, consider seeking advice from a tax professional.

Key takeaways

When it comes to navigating the complexities of the West Virginia Personal Income Tax Return (Form IT-140) for the year 2020, individuals must pay close attention to several critical areas to ensure accuracy and compliance. Here are six key takeaways for those filling out and using the WV Tax Form:

- Timely submission is crucial, with the personal income tax due date set for April 15, 2021. Filing after this date without an approved extension can lead to penalties and interest charges.

- Choosing the correct filing status is vital as it affects the calculation of your tax liability. The options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Widow(er) with Dependent Child. Proper selection impacts exemption amounts and tax rates.

- Exemption calculations require detailed attention, particularly regarding dependents, spouse, and personal allowances. These exemptions can significantly reduce taxable income, so verifying eligibility and accurately completing this section is essential.

- Understanding and accurately reporting income adjustments, both additions and subtractions, provides a clearer picture of the taxable income. These adjustments include state-specific exclusions and benefits, such as Social Security benefits modification and deductions for contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds.

- Taking advantage of credits and deductions, including Senior Citizen Tax Credit, Homestead Excess Property Tax Credit, and others, can reduce the overall tax liability. Documentation and eligibility verification are crucial for claiming these benefits.

- For those expecting a refund, ensuring the direct deposit information is accurate will expedite the transfer of funds. Incorrect account information can delay the refund process or result in fees.

Adhering to these guidelines when completing the West Virginia Tax Form can mitigate the risk of errors and the potential for additional assessments by the state tax department. Taxpayers should consider seeking professional advice if they encounter complexities or have specific questions about their tax situation.

Popular PDF Forms

How to Become a Resident of West Virginia - By stipulating penalties for non-compliance, the form underscores the importance of timely, accurate filings for both electronic and traditional submissions.

West Virginia State Tax Department - Surviving spouses can take advantage of a special deduction, offering additional tax relief.

Wv Abc - Explanation of the zoning form completion process by applicants within or outside city limits.